The Single Strategy To Use For Retirement Income Planning

Table of ContentsThe smart Trick of Retirement Income Planning That Nobody is Talking AboutThe 4-Minute Rule for Retirement Income PlanningThe Main Principles Of Retirement Income Planning Examine This Report on Retirement Income PlanningSome Ideas on Retirement Income Planning You Should Know

As with your 401(k), this is funded with pretax dollars, as well as the assets within it grow tax-deferred. Some employer-sponsored strategies supply a Roth option to establish apart after-tax retired life contributions.You wish to ensure that your family could make it through economically without drawing from retired life savings need to something happen to you. As you age, your financial investment accounts need to become extra traditional. While time is running out to conserve for people at this phase of retirement preparation, there are a couple of advantages.

And it's never far too late to establish up as well as add to a 401(k) or an IRA. One benefit of this retirement drawing board is catch-up contributions. From age 50 on, you can contribute an added $1,000 a year to your traditional or Roth individual retirement account and an additional $7,500 a year to your 401(k) in 2023.

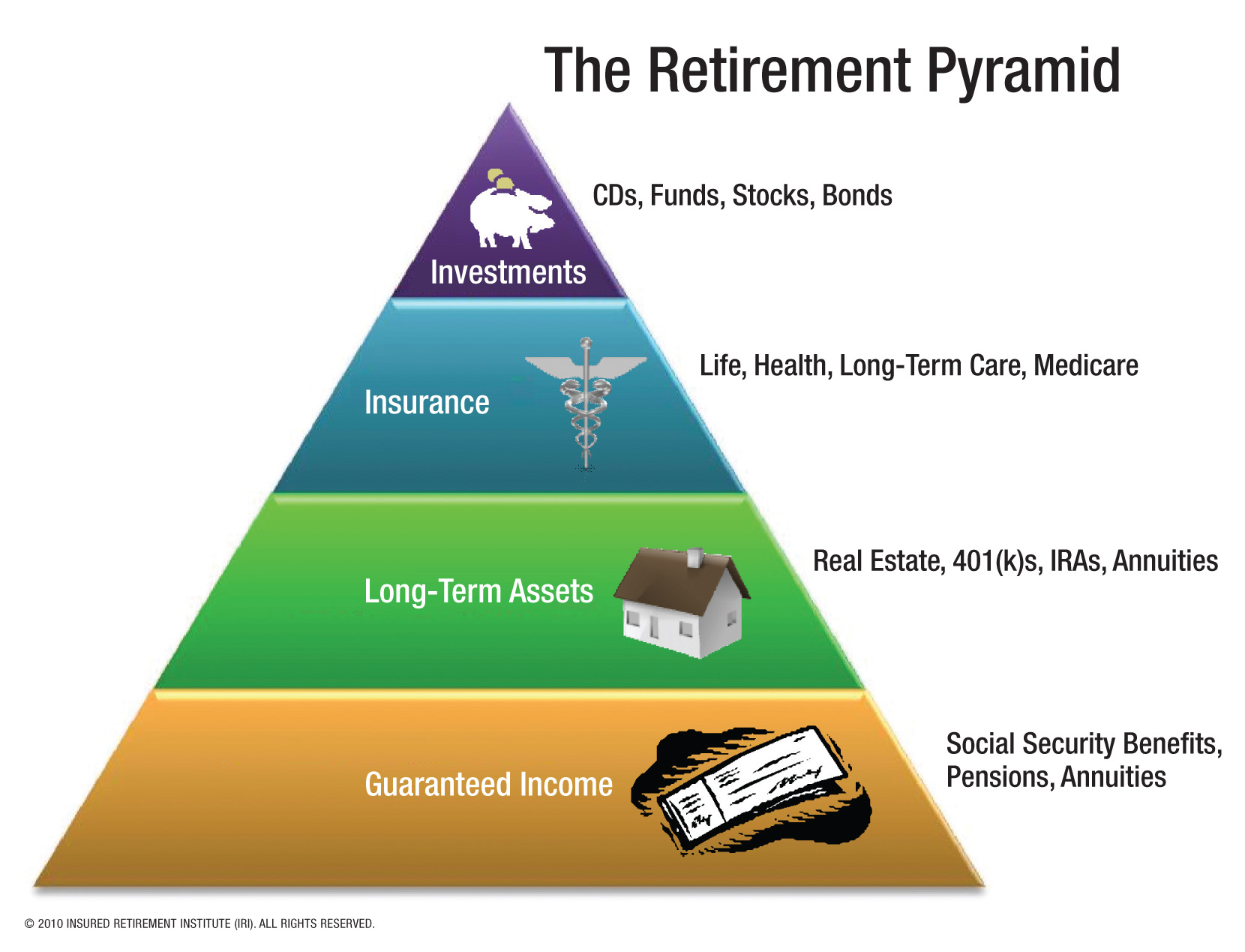

Deposit slips (CDs), leading stocks, or certain property financial investments (like a villa that you rent out) might be reasonably safe ways to contribute to your nest egg. You can additionally begin to obtain a sense of what your Social Safety and security advantages will be and also at what age it makes good sense to start taking them.

Retirement Income Planning Can Be Fun For Everyone

, which will help cover the prices of a nursing home or house care must you require it in your advanced years. If you do not correctly plan for health-related expenditures, specifically unanticipated ones, they can decimate your cost savings.

It takes into account your full monetary image. For a lot of Americans, the single largest asset they have is their house. How does that match your retirement? A home was taken into consideration an asset in the past, but because the housing market crash, coordinators see it as less of an asset than they once did.

When you retire, there's also the inquiry of whether you must sell your house. If you still live in the house where you raised multiple children, it may be extra significant than you require, and the expenditures that come with holding onto it may be substantial. Your retirement must consist of an impartial consider your home and what to do with it.

As of 2023, the initial $12.

An Unbiased View of Retirement Income Planning

An additional kind of plan provided by an insurance coverage firm is an annuity. You placed money on down payment with an insurance coverage company that later on pays you an go to this site established monthly This Site amount.

It's as very easy as reserving some cash every monthevery little bit matters. The easiest means is to start adding through an employer-sponsored plan if your firm provides one. You might likewise want to think about talking to a professional, such as a financial coordinator or investment broker that can steer you in the appropriate direction.

That's why it's so crucial to have a feasible strategy that permits you to get the optimum quantity of cash when you retire. Retired life planning is such an integral part of your economic wellness. There are other things you need to take into consideration exterior of what happens after you retire.

You may likewise wish to consider what occurs to your assets after you die, which is where estate planning enters play. Life insurance policy can help balance out any kind of costs that you leave behind for your loved ones if you end up being injured or pass away unexpectedly. Everybody imagine the day they can ultimately say bye-bye to the labor moved here force and retire.

The Only Guide for Retirement Income Planning

You can then bank on appreciating life nevertheless those years of effort. It not just reduces headaches in your retired life years yet additionally eliminates stress in the years leading up to it. The earlier you begin, the longer the time framework your money obtains for compounding. Intensifying creates incomes on your previous profits.

And medical costs can be high. With rising inflation, the price of sufficient medical care can transform expensive by the time you retire. But illness typically strike without caution. Additionally, life can toss a curveball at you when you the very least expect it, resulting in unanticipated expenditures. It is better to prepare for such expenses when you are healthy as well as earning.

Therefore, when the time comes, you need not encounter any kind of problem in paying your costs. Retirement intending supplies numerous tax obligation * benefits: You can deduct your contribution in the direction of pension plan strategies from your gross income, decreasing your tax obligations Some retirement payouts are likewise either tax-free or only partly taxable Likewise, the excellent technique to save money on taxes is to go with tax obligation diversity.

Facts About Retirement Income Planning Uncovered

There are a number of benefits of retirement planning that range from both financial to personal as well as psychological. Let's look at 7 common factors why preparation for your retired life can work for you.